what tax form does instacart use

If you are a tax-exempt organization and do not have a Staples Tax-Exempt Customer Number please follow these steps. Form 1099-K does not change the tax rules for gambling.

Is This How Instacart Sends Out 1099s Or Is This A Scam R Instacartshoppers

Digital Commerce 360 offers daily news and expert analysis on retail ecommerce as well as data on the top retailers in the world.

. A sales tax exemption claim form. You can review and edit your tax information directly in the Instacart Shopper App. Select the Request a Price Adjustment button below and complete the form.

IRS deadline to file taxes. Hurdlr is a cool app that helps drivers find an average of 5600 in tax deductions. You will not be able to edit your tax.

Instacart Express is the apps membership service and you can pay a one-time fee of 99 for an annual membership or 9. Situations covered in TurboTax Free Edition includes. The bottom line is that it is not prohibited to sell cigarettes online but an order is supposed to be followed.

Register your Instacart payment card. JPMorgan Chase Declares Preferred Stock Dividends Aug 15 2022. On a cover sheet please include your telephone number and order number if applicable.

We reserve the right to deny price adjustments at our sole discretion. Youll need your 1099 tax form to file your taxes. This can make for a nasty surprise when tax time rolls around as youre responsible for paying the necessary state and federal income taxes on the money you make delivering for Instacart.

The IRS required DoorDash to send form 1099-NEC instead of 1099-MISC beginning in the 2020 tax year. Here is a roundup of the forms required. How to Request a Price Adjustment.

Costco does not price match with other sellers. To learn more about the differences between the GET and sales tax please see Tax Facts 37-1 General Excise Tax GET. Instacart 1 Year Membership 4.

Instacart shoppers use a preloaded payment card when they check out with a customers order. The taxes on your Instacart income wont be very high since most drivers are making around 11 per hour but you still need to set aside some of the. Morgan Launch Founder Catalyst Program in Oakland Aug 10 2022.

A simple tax return is Form 1040 only OR Form 1040 Unemployment Income. That means you keep more of what you earn. Delivery fees start at 399 for same-day orders over 35.

Simply complete BuyerZones request form below. Additionally Huggies points accrue to key milestones and are awarded based on the final purchase price excluding any tax delivery and other charges other than the product itself as accumulated over time and noted here. A Form 1099-MISC Miscellaneous Information or Form 1042-S Foreign Persons US.

Please do not write on your tax certificate. Heres the breakdown on Staples delivery cost via Instacart. Fax your tax certificate to Staples at 888-823-8503.

Remember the SAR 7 form is considered incomplete if you fail to answer all the questions that apply to the benefits you are receiving. Mystery Shopping and Audit Apps 35. Field Agent presents a list of tasks you can do based on your.

In fact they dont currently deliver any tobacco products. Does Instacart charge an annual fee. JPMorgan Chase to Present at the Barclays Global Financial Services Conference Aug 05 2022.

JPMorgan Chase Files Form 10-Q for the Quarter Ended June 30 2022 Aug 03 2022. With the Instacart MastercardR Credit Card earn 5 cash back on all Instacart purchases 5 cash back on airlines hotels and more when booked through Chase Travel Center and 2 cash back at gas stations restaurants and on select streaming services. Open the Menu in the upper left corner choose Your Orders find the order in question and tap the Report a Problem button.

Book a PAID Consultation. The app automatically tracks all your mileage expenses income streams and tax deductions in real-time. The third step in the SAR 7 form completion process is to answer all the 13 questions on the form if applicable.

150 total spent on eligible products 5000 Fetch Points 350 total spent on eligible products 10000 Fetch Points. It allows for customization and flexible scheduling options. W-2 income limited interest and dividend income reported on a 1099-INT or 1099-DIV claiming the standard deduction Earned Income Tax Credit EIC child tax credits unemployment income reported on a 1099-G.

DoorDash dashers will need a few tax forms to complete their taxes. How much does Staples delivery or pickup via Instacart cost. The tax rate is 015 for Insurance Commission 05 for Wholesaling Manufacturing Producing Wholesale Services and Use Tax on Imports For Resale and 4 for all others.

You would still follow the above rules. Form 1099-K is an additional tax form the payment processor has to issue. And to prevent tax evasion on the product.

On the Instacart smartphone app. The essential tech news of the moment. When logged in to the Instacart website click Account in the top right corner choose Your Orders find the order in question and click the Report a Problem button.

How do I update my tax information. You also get reduced service fees with Instacart Express. It is separate from a W2-G.

Part-time employees sign an offer letter and W-4 tax form. Instacart does not deliver cigarettes. Does Instacart Charge An Annual FeeFor 149 per year you can get free two.

DoorDash dashers who earned more than 600 in the previous calendar year will receive a 1099-NEC form through their partner Strip. Instacart has changed the way people go grocery shopping. Technologys news site of record.

On the Instacart website. Instacart will file your 1099 tax form with the IRS and relevant state tax authorities. When filing your tax return you do not necessarily report the amount on your 1099-K.

Uber DoorDash Instacart and Grubhub delivery workers have found that the systems the companies put in place dont necessarily keep their earnings safe from. Once approved credits are typically issued within 5 to 7 business days to the original form of. You report your actual winnings and losses.

Our Tax Department will process your exemption after youve placed your order and submitted the following documentation. Failure to answer applicable questions may result in your benefits being canceled delayed or. A copy of your resaletax exempt documentation.

How To Handle Your Instacart 1099 Taxes Like A Pro

Instacart Credit Card Chase Com

Filing Your Taxes As An Instacart Shopper Tax Tips For Independent Contractors Youtube

The 4 Apps Every Instacart Shopper Needs To Use Maximum Tax Deductions Avoid Deactivation More Youtube

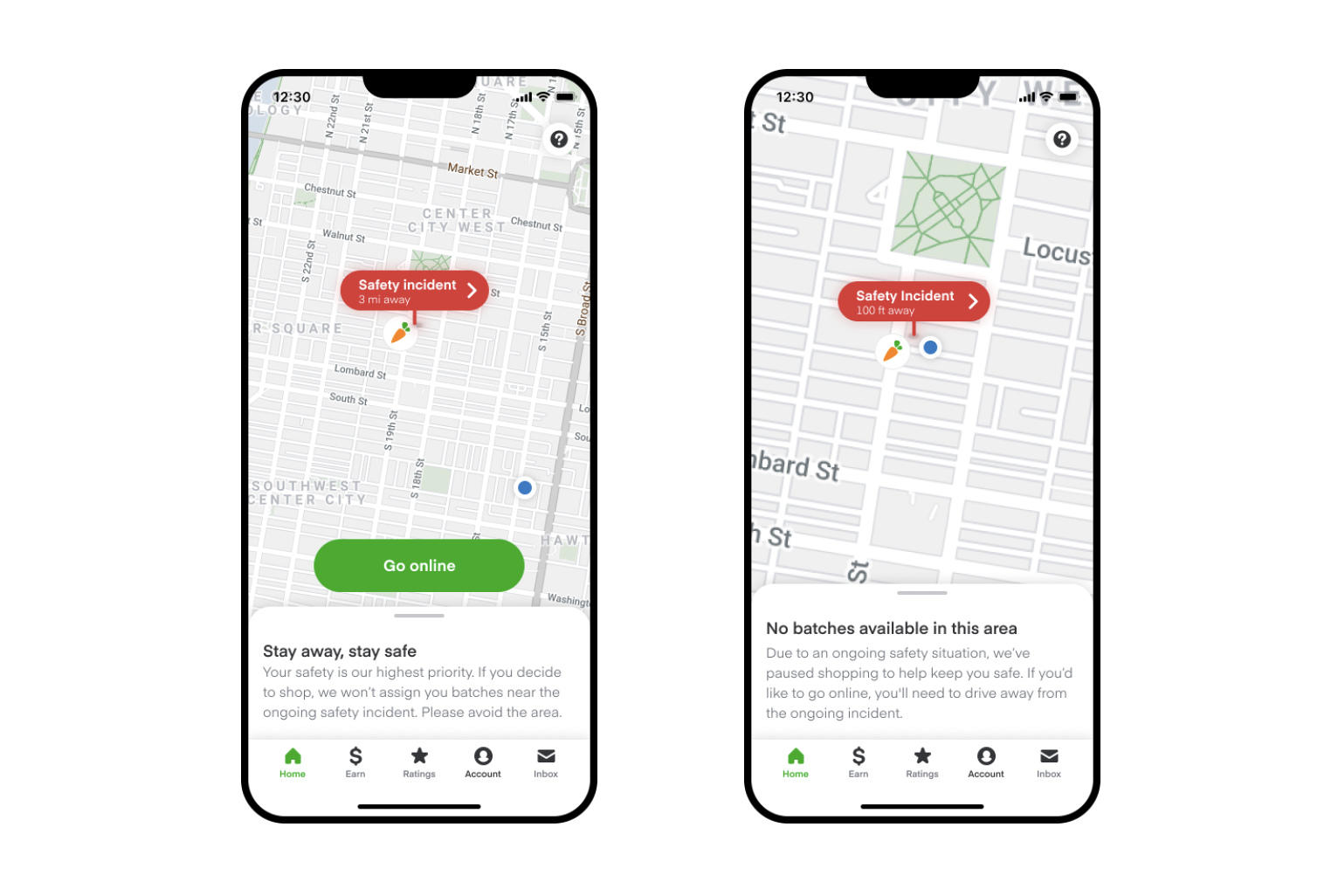

Instacart Introduces New Shopper Safety Alert Feature For Delivery People On The Platform Techcrunch

/cloudfront-us-east-2.images.arcpublishing.com/reuters/V3GDCFWRVFMCRDBX3CLRCBKVAI.jpg)

Grocery Delivery App Instacart Founder Mehta To Step Down As Chairman Reuters

How To Rate Your Shopper And Delivery Driver For Instacart

Instacart Taxes The Complete Guide For Shoppers Ridester Com

Instacart Taxes The Complete Guide For Shoppers Ridester Com

What You Need To Know About Instacart Taxes Net Pay Advance

The Instacart Business Model How Do They Make Money

Pin On Food Groceries Eating Out Recipes

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

How To Complete An Instacart Delivery Wikihow

Instacart Tips Make The Service Too Expensive Review

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

How To Get Instacart Tax 1099 Forms Youtube

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

Guide To 1099 Tax Forms For Instacart Shoppers Stripe Help Support